Utility connection fees, varying 5%-15% based on location and infrastructure, significantly impact new build costs. Proactive planning, regulatory awareness, and innovative solutions like shared infrastructure and renewable energy adoption can mitigate these fees, ensuring financially viable projects that align with sustainability goals.

In the intricate landscape of borrowing and lending, understanding the subtle yet significant impacts of utility connection fees is paramount for both financial institutions and borrowers. These fees, often overlooked, significantly influence the overall cost structure for borrowers, especially in today’s dynamic economic climate. This article delves into the current trends surrounding utility connection fees, shedding light on their far-reaching implications. By examining these trends, we aim to equip readers with valuable insights that promote informed decision-making and strategic financial planning, fostering a more transparent and efficient borrowing environment.

Understanding Utility Connection Fees: A Basic Overview

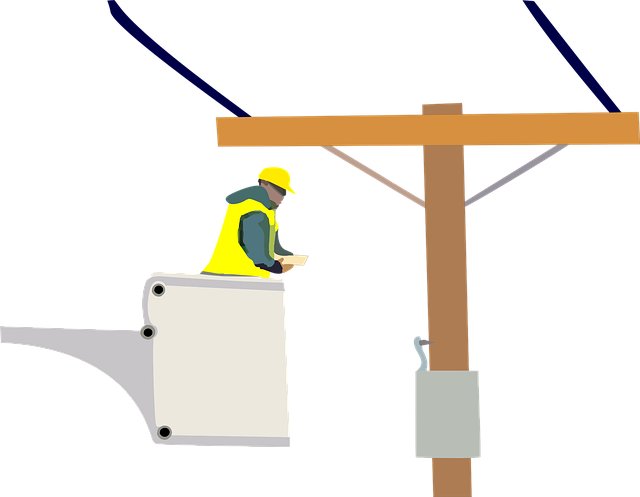

Utility connection fees play a significant role in increasing borrowers’ costs, particularly in new build projects. These fees encompass the expenses incurred when connecting a property to public utility services such as electricity, gas, water, and sewerage. Understanding these charges is crucial for borrowers and lenders alike, as they can significantly impact the overall cost of a project. A breakdown of these fees typically includes various components like connection charges, application fees, inspection costs, and sometimes even infrastructure development expenses.

In new builds, utility connection fees can vary widely depending on several factors. For instance, connecting a property to an existing grid might be less costly than constructing new infrastructure to serve a remote area. As per recent industry data, the average utility connection fee for residential properties in urban areas ranges from 5% to 10% of the total project cost, while commercial projects can see fees reaching up to 20%. This variation underscores the need for comprehensive budgeting and careful consideration during the planning phase.

For borrowers, transparency and proactive financial planning are key when addressing utility connection fees. Lenders should provide clear disclosures about these costs, enabling borrowers to factor them into their financing strategies. One practical approach is to allocate a certain percentage of the budget specifically for utility connections, ensuring that unexpected surges in fees don’t catch borrowers off guard. Moreover, staying informed about local regulations and industry trends can help anticipate potential changes in connection fee structures, allowing for more effective financial management throughout the construction process.

The Impact on Borrower Costs: Analysis and Trends

Utility connection fees play a significant role in influencing borrower costs, particularly in the context of new builds. As these fees become increasingly integrated into construction projects, understanding their impact is crucial for both borrowers and lenders. A comprehensive analysis reveals that utility connection fees can add substantial financial strain on borrowers, with costs ranging from several hundred to thousands of dollars, depending on location and infrastructure requirements. For instance, in urban areas where existing infrastructure is well-developed, the average fee for connecting a new build to the grid might be around $2,000, while in remote locations, this figure can skyrocket to $5,000 or more due to the need for extended installations.

The trend towards higher utility connection fees in new builds is driven by several factors. The first is the increasing complexity of infrastructure projects required to meet modern energy demands and environmental standards. Additionally, rising material costs and labor shortages further exacerbate these fees. For borrowers, this translates into larger upfront expenses, potentially impacting their ability to secure financing or affecting the overall budget allocated for construction. To mitigate these challenges, borrowers can explore options such as pre-application for utility connections during the initial planning stages, which may entitle them to discounted rates. Engaging with local utilities to understand fee structures and negotiating contracts early in the process can also help manage costs effectively.

Moreover, government incentives and subsidies aimed at promoting renewable energy adoption often influence these fees. In many regions, connecting new builds to renewable energy sources like solar or wind power reduces utility connection charges as a way to encourage sustainable practices. Borrowers looking to take advantage of these incentives should consult with both lenders and local authorities to ensure they meet eligibility criteria. Understanding the interplay between utility connection fees and government initiatives can help borrowers navigate financial complexities, ensuring their projects remain cost-effective while aligning with environmental goals.

Current Market Dynamics: Fee Variations Across Sectors

In today’s dynamic market, understanding how utility connection fees influence borrower costs is crucial for navigating new builds and developments. The landscape of these fees varies significantly across sectors, with notable differences between urban and rural areas, as well as between different utilities like electricity, water, and gas. For instance, according to recent data, the average utility connection fee for new homes in major metropolitan regions can range from 5% to 10% of the overall construction cost, compared to just 2-4% in suburban or rural areas. This disparity is driven by factors such as infrastructure investment, regulatory requirements, and competition among service providers.

When considering new builds, borrowers should be aware that these fees are not static. They are subject to market trends, technological advancements, and policy changes. For example, the rollout of smart grid technologies has led to more efficient utility systems, potentially reducing connection fees over time. Conversely, increasing environmental standards may necessitate higher upfront investments for developers, which could be passed on to borrowers in the form of elevated utility connection fees. To mitigate these costs, borrowers can strategically choose builders and locations that offer competitive pricing or take advantage of government incentives aimed at easing the financial burden associated with utility connections.

Moreover, lenders play a pivotal role in managing these costs by offering flexible financing options tailored to the unique fee structures of different regions. Some lenders are even pioneering innovative models, such as capped fees or fixed rates, to protect borrowers from unexpected spikes in utility connection expenses. Staying informed about current market dynamics and fee variations across sectors is, therefore, paramount for both borrowers and lenders alike. By proactively understanding these trends, stakeholders can make more informed decisions that align with the evolving landscape of utility connection fees.

Regulatory Influences: Policy Changes and Their Effect

Regulatory influences play a pivotal role in shaping how utility connection fees impact borrowers’ costs, especially in the context of new builds. Policy changes aimed at promoting affordability and accessibility have led to significant shifts in these fees. For instance, governments worldwide have implemented measures to streamline the connection process for developers and homeowners, reducing administrative burdens and associated costs. These initiatives often involve standardizing application procedures and setting clear guidelines for utility providers, which can lower new build projects’ overall expenses.

The introduction of digital platforms and automated systems has further contributed to this trend. Many regions have adopted smart city technologies that enable efficient management of utility connections. These digital solutions allow for faster processing of requests, real-time tracking of applications, and improved communication between stakeholders. As a result, developers can anticipate and better manage their project timelines and budgets, with reduced exposure to unexpected utility connection fee surcharges.

However, the impact of regulatory influences extends beyond cost savings. Policy changes also drive innovation in the utilities sector, encouraging companies to explore new models that benefit borrowers. For example, some regions have introduced pilot programs for shared infrastructure, where multiple developers pool resources to connect to common utilities, reducing individual connection fees. This collaborative approach not only lowers costs but also promotes sustainable development practices, ensuring a more vibrant and efficient construction landscape.

Experts suggest that policymakers should continue to engage with industry stakeholders to refine these policies. Regular reviews and data-driven analyses can help identify areas for improvement, ensuring utility connection fees remain fair and transparent. Developers and borrowers alike stand to gain from such efforts, fostering an environment that supports responsible borrowing and responsible infrastructure development.

Case Studies: Real-World Examples of Cost Implications

Utility connection fees have emerged as a significant factor influencing borrowers’ costs, particularly in new build projects where these fees can represent a substantial portion of overall expenses. Recent trends reveal a growing awareness among developers and policymakers regarding the impact of these charges, leading to more transparent pricing structures and innovative solutions.

Case studies from around the globe offer compelling insights into the real-world implications of utility connection fees. In urban areas with high population densities, such as London, England, where new build projects often face stringent infrastructure requirements, utility connection fees can escalate dramatically. According to a 2022 report by the Greater London Authority, these fees accounted for approximately 15% of the total construction cost for residential developments, with some high-rise projects facing fees exceeding 25%. This substantial cost burden has prompted developers to explore alternative financing models and engage in closer collaboration with local utility providers to streamline connection processes.

In contrast, regions with lower population densities or more relaxed urban planning regulations exhibit different trends. For instance, rural areas in the Midwest United States often experience reduced utility connection fees due to lower infrastructure demands and more flexible regulatory frameworks. A study by the Federal Reserve Bank of Minneapolis (2021) found that in some cases, these fees were as low as 5% of total construction costs for new builds. This disparity highlights the need for a nuanced understanding of local market dynamics and regulatory environments when assessing the financial implications of utility connection fees.

To navigate these complexities effectively, borrowers and developers should prioritize proactive engagement with utility providers early in the project planning phase. Negotiating favorable terms, exploring shared infrastructure models, and taking advantage of available incentives or grants can significantly mitigate the impact of utility connection fees. Additionally, staying informed about regulatory changes and industry best practices ensures that projects are designed and executed in ways that optimize cost-effectiveness while adhering to relevant standards.

Strategies for Borrowers: Mitigating Utility Connection Fees

Utility connection fees have emerged as a significant factor influencing borrowers’ overall costs, particularly in the context of new builds. With construction projects often facing rising material and labor costs, understanding how these fees can be mitigated is crucial for both developers and homeowners. This section delves into strategies that borrowers can employ to navigate and reduce utility connection expenses, ensuring more affordable and feasible new build projects.

One of the primary approaches to managing utility connection fees involves proactive planning and engagement with local utility providers. Borrowers should initiate discussions well in advance of construction, exploring options for customized rates or bundled services. For instance, negotiating rates for electric, water, and gas connections as a package could result in substantial savings, especially for large-scale developments. Additionally, staying informed about regulatory changes related to utility infrastructure can open doors to new opportunities. As new builds often require modernizing or expanding utility networks, developers can advocate for infrastructure upgrades that may lead to more efficient and cost-effective services over time.

Data suggests that utility connection fees in new builds can range from 5% to 15% of the total construction cost, depending on location and utility type. To mitigate these costs, borrowers should consider innovative solutions. For example, implementing smart grid technology or exploring renewable energy sources for power and heating can reduce utility expenses over the long term. Furthermore, adopting water-efficient fixtures and systems not only lowers utility bills but also aligns with environmental sustainability goals, making it a win-win strategy. By embracing these measures, borrowers can significantly reduce their exposure to variable utility connection fees, ensuring that new build projects remain financially viable and attractive.