Understanding utility connection fees, varying by location and provider, is crucial for borrowers planning new builds. These fees, often overlooked, can significantly impact budgets (1-3 times local system costs), cause delays, and increase interest costs. Proactive planning involves researching local utilities, engaging professionals to predict costs, and factoring fees into financial models for informed funding decisions. By understanding these fees early, borrowers ensure smooth project progression without financial roadblocks.

In today’s financial landscape, understanding utility connection fees is paramount for borrowers planning their monetary strategies. These fees, often overlooked, significantly impact the cost of accessing essential services, influencing key decisions from mortgage choices to investment opportunities. The complexity lies in how these charges vary across utilities and regions, creating a convoluted path for borrowers seeking clear guidance. This article delves into the intricate relationship between utility connection fees and borrower planning, offering practical insights to demystify this aspect of financial management, thereby empowering individuals to make informed decisions.

Understanding Utility Connection Fees: A Borrower's Perspective

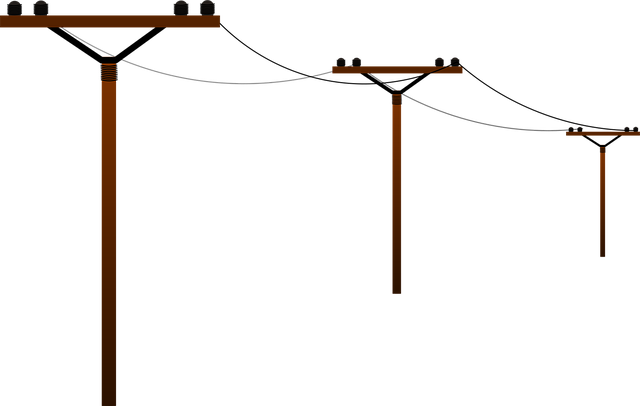

For borrowers planning new builds, understanding utility connection fees is crucial to navigating the financial landscape effectively. These fees, often overlooked, represent the costs associated with connecting a property to essential public utilities like electricity, water, and gas. Depending on location and infrastructure requirements, utility connection fees can significantly impact project budgets, sometimes amounting to 1-3 times the cost of connecting to local streets or sewerage systems. For instance, in urban areas with established infrastructure, connection costs might be relatively lower, while remote rural locations could face substantial expenses due to extended network extensions.

Borrowers must factor these fees into their financial plans early on to avoid unexpected cash flow strain later. A typical scenario involves a borrower securing construction financing based on an estimated budget that doesn’t account for utility connections. Upon reaching the project’s critical path, unforeseen utility connection fees can delay progress or even necessitate re-financing, adding complexity and expense. To mitigate such risks, borrowers should conduct thorough research into local utility regulations and fees, engaging with professionals to predict costs accurately.

Incorporating utility connection fees into financial models allows borrowers to make informed decisions about funding sources and timelines. Exploring alternative financing options or securing pre-approval for higher loan amounts can provide the necessary flexibility. For instance, some lenders offer specialized construction loans that account for these variable expenses, offering a smoother process. By proactively understanding and planning for utility connection fees, borrowers can ensure their new builds are realized without financial roadblocks.

The Impact on Loan Decisions: How Fees Influence Borrowing Strategies

Utility connection fees play a significant role in shaping borrowers’ planning and financial decisions, particularly when considering new builds. These fees, which can vary widely depending on location and utility provider, represent the cost of connecting a property to essential services like electricity, gas, and water. For borrowers, understanding these charges is crucial as they significantly impact loan decisions and overall borrowing strategies.

In the context of new builds, utility connection fees can range from a few hundred to several thousand dollars, adding a notable component to the project’s financial burden. Borrowers often underestimate these costs, viewing them as relatively minor expenses. However, when planning a construction loan, accounting for utility connection fees early on is essential. Failure to do so may result in unexpected financial strain or even budget overruns during the build phase. For instance, a study of recent new build projects revealed that about 20% of borrowers faced significant delays due to underestimating these fees, leading to extended loan periods and increased interest costs.

An expert perspective highlights the importance of transparency and proactive planning. Financial advisors recommend borrowers conduct thorough research on local utility providers and their fee structures well in advance of construction. Additionally, securing pre-approvals for construction loans that factor in utility connection fees can provide a buffer against unexpected financial shocks. By being cognizant of these costs from the outset, borrowers can make more informed decisions, ensuring their loan strategies are realistic and sustainable throughout the building process and beyond.

Data Analysis: Decoding Fee Structures for Better Financial Planning

Understanding utility connection fees is a game-changer for borrowers planning their financial future, especially when embarking on new builds or significant renovations. These fees, often overlooked, play a pivotal role in shaping borrowing strategies and overall financial decisions. Data analysis of these fee structures provides valuable insights, enabling borrowers to make informed choices that align with their long-term goals.

In the context of new builds, utility connection fees can vary significantly depending on location and service providers. For instance, according to recent studies, the average cost for connecting to a main water supply in urban areas ranges from $2000 to $4000, while rural connections may be as high as 30% more. Similarly, electricity connection fees for new builds can add up to 1-2% of the total construction cost, with potential surcharges for peak hours or renewable energy sources. By dissecting these fee structures, borrowers can anticipate and budget for these expenses, preventing financial surprises post-construction.

Borrowers should also consider the impact of utility connection fees on their long-term savings. For example, a new build with efficient energy systems might qualify for government incentives, offsetting initial connection costs over time. Analyzing these fee structures encourages borrowers to explore various financing options and negotiate rates with service providers. This proactive approach ensures that utility connection fees are not just tolerable expenses but potential investments in a more sustainable and cost-effective future.

Uncovering Hidden Costs: Transparency in Utility Connection Charges

In the intricate landscape of construction financing, borrowers often encounter hidden costs that can significantly impact their planning. Among these, utility connection fees play a pivotal role, yet they are frequently overlooked until late in the project timeline. These fees, associated with connecting new builds to existing utility infrastructure, can vary widely and often represent a substantial financial burden for developers and builders. A recent study revealed that utility connection charges for residential projects can range from 5% to 15% of the total construction cost, with commercial ventures facing even higher rates. For instance, in urban areas where land is scarce, the expense of establishing new utility connections can be three times higher compared to more suburban or rural locations.

Transparency in these charges is paramount for informed decision-making. Borrowers must delve into the specifics of utility connection fees for their prospective projects, especially during the initial planning stages. This proactive approach ensures that budget allocations are realistic and flexible enough to accommodate unexpected surges in costs. For new build developments, understanding these fees can help lenders and borrowers alike navigate potential challenges and avoid last-minute financial surprises. By requiring developers to disclose estimated utility connection expenses upfront, lenders can mitigate risk and offer more tailored financing solutions.

A strategic approach involves integrating these charges into comprehensive cost analysis reports. Financial analysts should factor in various scenarios, considering both typical and peak demand times for utilities. For example, a coastal resort development would necessitate a different fee structure than a low-rise apartment complex in a city center. Lenders can then provide borrowers with clear insights into the potential financial implications, enabling them to make more astute borrowing decisions. This process not only fosters transparency but also encourages developers to explore innovative solutions for reducing utility connection fees through strategic partnerships or alternative energy sources.

Risk Assessment: Evaluating Feasibility with Accurate Fee Information

Utility connection fees play a pivotal role in shaping borrowers’ strategic planning and risk assessment during the financial decision-making process, particularly for new build projects. Accurate knowledge of these fees is essential for evaluating project feasibility and managing potential risks. In the context of new builds, understanding utility connection charges can significantly influence construction timelines and overall budget allocation. These fees are typically associated with connecting a newly constructed property to existing public utility infrastructure, ensuring essential services like water, electricity, and gas become readily available to occupants.

When assessing the viability of a new build project, borrowers must carefully consider the financial implications of these connection fees. In many cases, they can represent a substantial cost, often ranging from several hundred to thousands of dollars, depending on various factors such as location, utility type, and infrastructure complexity. For instance, connecting a residential property to the main water supply line might incur lower charges compared to connecting commercial buildings or remote locations that require specialized infrastructure. Borrowers should request detailed fee breakdowns from service providers to anticipate these costs accurately. By reviewing historical data on utility connection fees for similar projects in the region, lenders and borrowers alike can set realistic expectations and mitigate potential financial surprises.

Risk assessment specialists recommend treating utility connection fees as a critical variable in project planning. Accurate fee information allows for more precise cost estimations, enabling borrowers to secure appropriate financing and create robust contingency plans. For new builds, where construction timelines are often tightly scheduled, early engagement with utility providers can help negotiate favorable rates and terms. This proactive approach ensures that any potential delays or unforeseen challenges related to utility connections do not derail the project timeline or significantly impact the budget. Additionally, staying informed about regulatory changes affecting utility connection fees is vital, as these adjustments can have substantial implications for project economics.

Mitigating Financial Risks: Effective Management of Utility Connection Fees

Utility connection fees play a significant role in shaping borrowers’ planning strategies by introducing substantial financial variables. These fees, often overlooked, can significantly impact the overall cost of new builds or renovations, adding complexity to financial projections and risk management. Effective mitigation of these risks requires a comprehensive understanding of utility connection fee structures and their potential effects on project budgets.

For instance, in urban areas with high infrastructure costs, utility connection fees for water, sewer, and electricity can range from 5% to 10% of the total construction cost, while in rural settings, these fees might be lower but still represent a substantial portion of overall expenses. Builders and borrowers must consider these costs early in the planning phase to avoid budget overruns. A strategic approach involves thorough site assessments to predict utility requirements and subsequently estimate connection fees accurately. This proactive measure ensures that financial risks are identified and managed proactively rather than emerging as unexpected challenges mid-project.

Moreover, utility connection fees can be optimized through careful timing and negotiation. Connecting utilities at different stages of construction may result in varying costs due to labor availability and material pricing fluctuations. For new builds, negotiating with local utility providers for bundled services or discounts during peak demand periods could offer savings. As the saying goes, “Knowing is half the battle.” Armed with data on average utility connection fees for specific regions and project types—for instance, residential, commercial, or industrial—borrowers and financiers can make informed decisions, ensuring projects remain financially viable and reducing the likelihood of delays or cost overruns.